straight life policy term

See how a straight life policy compares to term or universal life. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums.

Protect Against Setbacks With Life Insurance Faithlife Financial Blog

The death benefit of a straight life policy.

. D Modified endowment contract. Learn the benefits of straight life insurance for individuals families and business. This traditional life insurance is sometimes also known as.

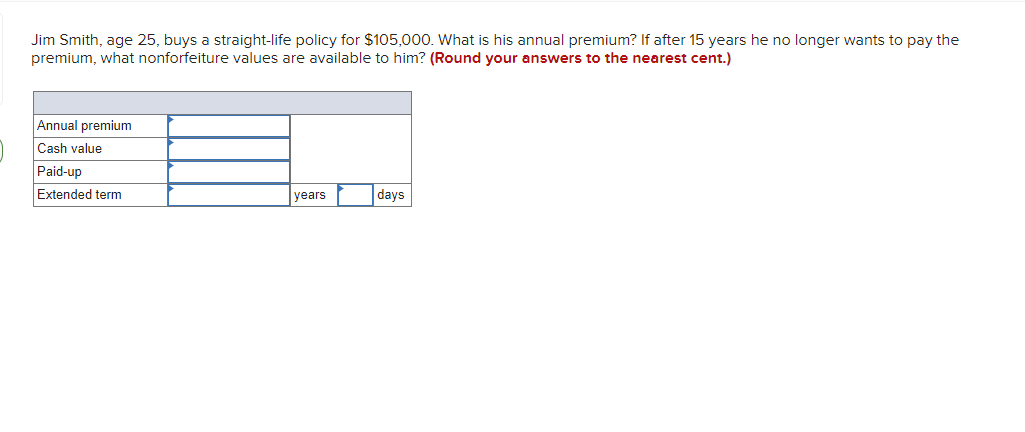

Term life insurance is typically purchased. A Joint life policy. Term life insurance death benefit amount Monthly premium for a 30-year-old male Monthly premium for a 30-year-old female.

Straight life insurance is a type of permanent life insurance. It is also known as ordinary life insurance. Premiums to purchase all forms of life insurance are based on mortality tables.

A straight life policy is an insurance policy that provides lifelong life insurance coverage with continuous level premium payments. Straight life insurance policies are designed for those looking for protection guaranteed cash value growth. While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Straight life policy term. The average cost of a 20-year term life insurance policy is 252 a year for 500000 in coverage for a 30-year-old female based on Forbes Advisors analysis of life.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. The type of life policy he is looking for is called a. The most one could borrow is the total value of the cash value in the insurance policy.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. Straight life insurance vs Term life insurance. A straight term insurance policy.

Also known as whole or ordinary life insurance the policy has a term length that lasts your entire life. Difference between straight life insurance vs. C Survivorship life policy.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. Policy riders to protect your loved ones. B Family income policy.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy. International Risk Management Institute Inc.

As an individual ages their cost of insurance rises. Straight whole life insurance require more premium than. Issued in an amount not to exceed the amount of the loan.

Most term life insurance policies offer a level death benefit. A Joint life policy. A life insurance policy that provides coverage only for a certain period of time.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

Jim Smith Age 25 Buys A Straight Life Policy For Chegg Com

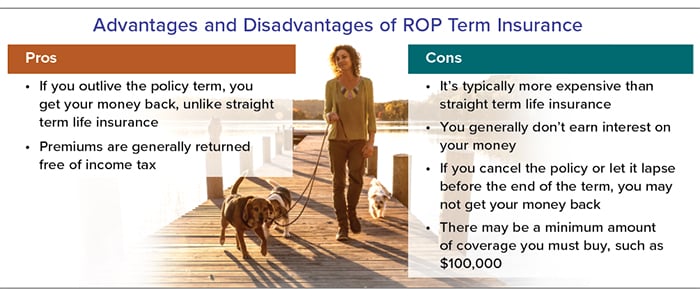

Return Of Premium Life Insurance Protection And Cash Back Annuityadvantage

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

What Is A Straight Life Annuity Everything You Need To Know

What Is A Ppo Preferred Provider Organization Part 2 Types Of Health Insurance Health Insurance Plans Dental Insurance Plans

Tips And Advice For Purchasing Life Insurance By Legalswamp7804 Issuu

What Is The Difference Between Term And Whole Life Insurance

Chapter 12 Life Insurance Ppt Download

Tbs Better Life 3 Pack Straight Plastic Rulers 6 8 12 Inches 15 20 30cm Measuring Ruler Tool Clear

Understanding The Different Types Of Insurance

Straight Life Insurance New York Life

What Is Straight Life Insurance Valuepenguin

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Personal Finance Another Perspective Insurance 2 Life Insurance Updated Ppt Download

Straight Life Annuity Explained In Simple Terms Due

Average Life Insurance Rates For October 2022 Nerdwallet

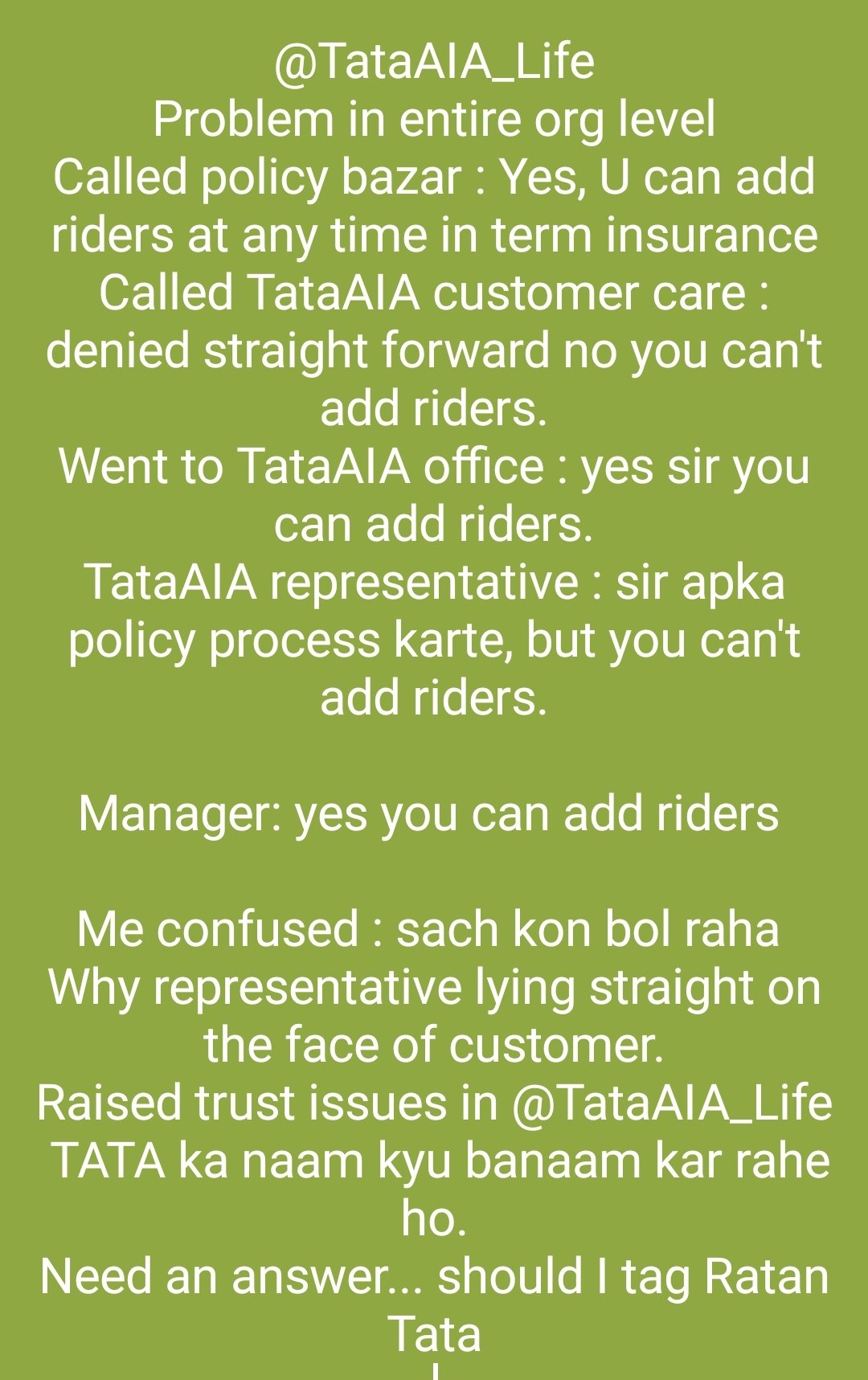

تويتر Tata Aia Life على تويتر Did You Know That The Tata Aia Life S Fortune Guarantee Plus Plan Offers You Guaranteed Long Term Income And An Inbuilt Critical Illness Benefit In Addition